Real Estate Prices in the San Fernando Valley are Breaking Records.

Experts weigh in on what the boom means for buyer and seller.

-

CategoryHomes

-

Illustrated byChristine Georgiades

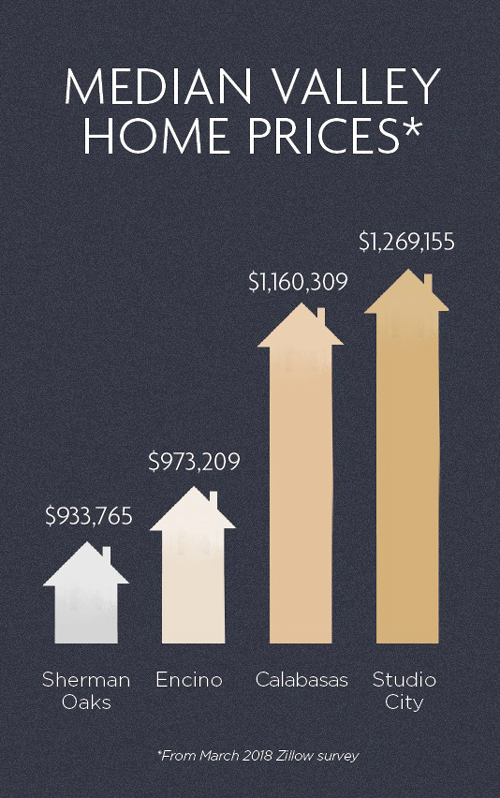

Property values in the Valley have never been higher. For 2017, the median home price was $700,000—up more than 16.7% from the previous year. To offer some insight, we queried two veteran realtors, Andrea Korchek, Director of Luxury Estates for The Agency and Oren Mordkowitz, Estates Director for Pinnacle Estate Properties. We also brought John Musso, Senior Wealth Management Lending Officer with Bank of America, into the conversation.

What are your thoughts on the 16.7% escalation in home prices here?

What are your thoughts on the 16.7% escalation in home prices here?

AK: The best analogy is Trousdale; there was a time when it was considered an embarrassing address if you wanted 90210. A few celebrity purchases and BOOM! Our wonderful Valley is now in that state of transition.

JM: That is a big increase for year over year. Due to lack of inventory, most areas in SoCal will move up in value. And there’s still room for increases as we are still 14% below the high for the region’s pre-recession peak.

OM: I’m not surprised. Home prices in the West LA areas are pushing more buyers to the Valley. If you compare a 1,000-square-foot fixer for $1 million (if you can find one) on the Westside, for the same price you can get a 1,800-square-foot, remodeled home in a good area of the Valley.

Why are Valley prices rising faster than LA?

AK: The Valley once had a derogative connotation. No longer. I’m selling to talented, educated, sophisticated and wealthy buyers who want to be here.

JM: Business wants to be here, too. Over 70,000 businesses are located here with both Fortune 500 and 1000 companies. Major industries are represented from aerospace to motion picture/TV to music/recording.

OM: It would make sense that year-over-year returns in LA would begin to somewhat slow a bit. The Valley had some catching up to do.

Why is this price increase in the Valley happening?

JM: Mainly the lack of inventory. The Valley is at an all-time low for listings over the past three months. In February, there were 958 homes listed, compared to the peak in July 1992 of 15,000 homes listed. Homes priced under $1 million are in high demand and buyers must be ready to compete for that property. Also many homeowners who are locked into historic low rates are reluctant to list their homes for sale. So we see baby boomers staying, not moving up or actually downsizing, putting even more strain on the middle-level housing. Lastly, there has been a lack of new residential construction to help with the supply.

It seems like a lot of young buyers are coming over the hill from the Westside.

AK: They have always migrated to the Valley when priced out of the Westside market. The entertainment industry has always been a draw, but the decision is still value driven. I’ve noticed that these young Westside buyers are no longer seeing their move to the Valley as temporary; they are buying homes and planning on raising families here.

OM: I think the younger buyers have realized the Valley offers them good schools, nice neighborhoods, a bit less traffic—and a better bang for the buck.

Let’s address the impact of the price rise on buyers.

AK: Unfortunately, it means a lot of money. And with the new tax laws limiting mortgage and property tax deductions, buyers are the true financial elite. It’s the reality of big city real estate, and it presents great challenges for hardworking professionals who are being priced out of all of our markets.

JM: They now have to buy less of a house if they are at their maximum. A house that was $600,000 now is $700,000.

OM: Buyers are frustrated with the lack of inventory—not terribly focused on how much prices have increased. They are more fearful of how much higher prices might go. It is frustrating for many buyers to lose out on numerous opportunities because of multiple offers. I’ve even seen buyers remove loan and appraisal contingencies and offer sellers a month free after close of escrow to try and get an offer accepted.

Speaking of multiple offers, should buyers go into a deal prepared for a bidding war?

AK: Any property that is priced well will receive multiple offers, and properties are selling way above the ask price. In this market, buyers must dress in their coat of arms, as it will kill you if you’re not prepared. If you find a property you want, you will have to be aggressive. Maybe the best strategy is to watch the properties that aren’t selling rather than race to the finish line on new listings. You may get a better value.

OM: I find lower price points or homes with special features tend to attract multiple buyers. One thing to keep in mind—the highest sale sets the bar for the next. It is likely that the next closely comparable home that comes on the market will be listed at an even higher price.

Is now the time to sell?

AK: Sell! Most experts predict some adjustment in prices, and historically, the real estate market does move up and down. In 2005, my manager offered this advice to our agents: “Save your money because as fast as real estate goes up, it comes down even faster.” She was right! If you do need or want to sell in the next few years, I would sell now, as it’s a sure thing.

JM: That’s a tough question. It depends on their particular situation and motivation. But it’s all relative; sell high, buy high.

OM: It is impossible to time the market. You should sell when you are ready. If you have planned to sell at the peak, then you should sell today.

What is the most expensive home you’ve listed in the past 12 months?

AK: The highest sale in 2017 in the Valley was mine at 17085 Rancho, which closed at $8.253 million. I also recently closed 13262 Galewood, Sherman Oaks for $7.5 million. These are huge price tags for the Valley. Only trophy properties are offered in this range. The Rancho property in Encino is over 10,000 square feet of newly remodeled living space on a 67,058- square-foot, flat lot. Galewood is a 9,000-square-foot New England traditional in prime Longridge Estates.

OM: The most expensive home I sold over the last year was $5.5 million; it was approximately 8,000 square feet, new construction on a nice cul-de-sac lot. It was one of the highest sales in the neighborhood a year ago.

Now we’re seeing lots of million dollar homes pop up on the north side of the Boulevard—often in the form of 5,000+-square-foot “spec” homes, surrounded by smaller, older homes. Conventional wisdom says, “Never buy the most expensive house in the neighborhood.” Thoughts?

AK: That is sound advice, even today. That said, I personally prefer some of the neighborhoods north of Ventura Boulevard, as they are beautiful tree-lined streets, walking distance from great restaurants, with a true sense of community among the residents. Studio City, north of the Boulevard, already turned over and is considered prime real estate. There are some pockets in Sherman Oaks that still are transitioning.

OM: It is safe to say, if it can be torn down, it will. Neighborhood landscapes are changing quickly. Buyers are enamored with new construction and builders are eager to find anything they can bulldoze. Buying the nicest home on the block is no longer the concern as buyers know there will be an even nicer home on the block soon enough.

How frequently are you involved in bidding wars which result in homes appraising below “value?”

How frequently are you involved in bidding wars which result in homes appraising below “value?”

JM: Buyers may be willing to overpay for a property due to lack of supply, increased competition and if the property is located in the right neighborhood and school district—particularly if they are in it for the long haul. Buyers need to be prepared to put more money into the deal if they want the property and it does not appraise for the accepted offer price. The seller may be more inclined to go with cash buyers or will need to negotiate with the buyer due to a low appraisal.

Offer a few options for the buyer who is looking in the $400,000 to $500,000 range.

AK: There are still a few properties available in Van Nuys and North Hollywood, but they go fast. Buyers in that range may best consider a condominium, allowing them the benefits of ownership, including building equity and time to save for their next big purchase. Remember, if you put down 20% on a $500,000 condo ($100,000), and the condo increases in value to $600,000, you have doubled your investment, which is undoubtedly better than earning a marginal rate in a bank account. Even more compelling, the mortgage payment, property taxes and HOA fees combined could well be less than you would pay for rent on the same unit, when you factor in tax advantages.

OM: You may be able to find something in Reseda, Chatsworth, North Hills or Lake Balboa. Those are tough price points at the moment. If you are able to find something worthwhile in that price range, expect multiple offers.